A groundbreaking web3 finance opportunity for investors

WHO, WHAT:

Bulla Finance is a new feature that uses the Bulla Network protocol to tokenize invoices and claims as input to a new lending pool. This initial pool will provide liquidity for the transportation industry. Going forward, Bulla will leverage this functionality for many other industries, including manufacturing and a range of service industries.

Bulla Network, an on-chain credit protocol, has added this feature to its core offerings to help web3 businesses organize their finances and run crucial operations.

USE CASE:

TCS Blockchain is the world’s first and only blockchain alternative to freight invoice factoring – dedicated to lowering the cost of settlement up to 90 percent for transportation companies. TCS will use the Bulla Network protocol plus a Bulla Finance Lending Pool to enhance liquidity for more than 400 trucking companies.

HOW IT WORKS:

Bulla’s protocol enables TCS to tokenize invoices related to any bill of lading (BOL). TCS can then offer these tokens for AR finance to the Bulla Finance pool. The pool funds these tokenized invoices at a discount and waits for invoices to be paid. Insurance companies or other institutions holding USDC can earn a fee and deposit or redeem from the lending pool.

VALUE PROPOSITION:

This is the first uncollateralized provision of short-term liquidity for businesses and solopreneurs that is completely on-chain. This integration leverages all of the advantages of the blockchain: It streamlines the loan process, improves auditability, increases transparency and should lower costs

THE MISSION:

Bulla hopes to host a credit DAO that eliminates exclusivity in liquidity provision and enables a self-sovereign banking and lending ecosystem.

Bulla Finance Facilitates P2P Loans

The Bulla protocol mints credit relationships between people, and FrendLends operate like simple on-chain “IOUs.”

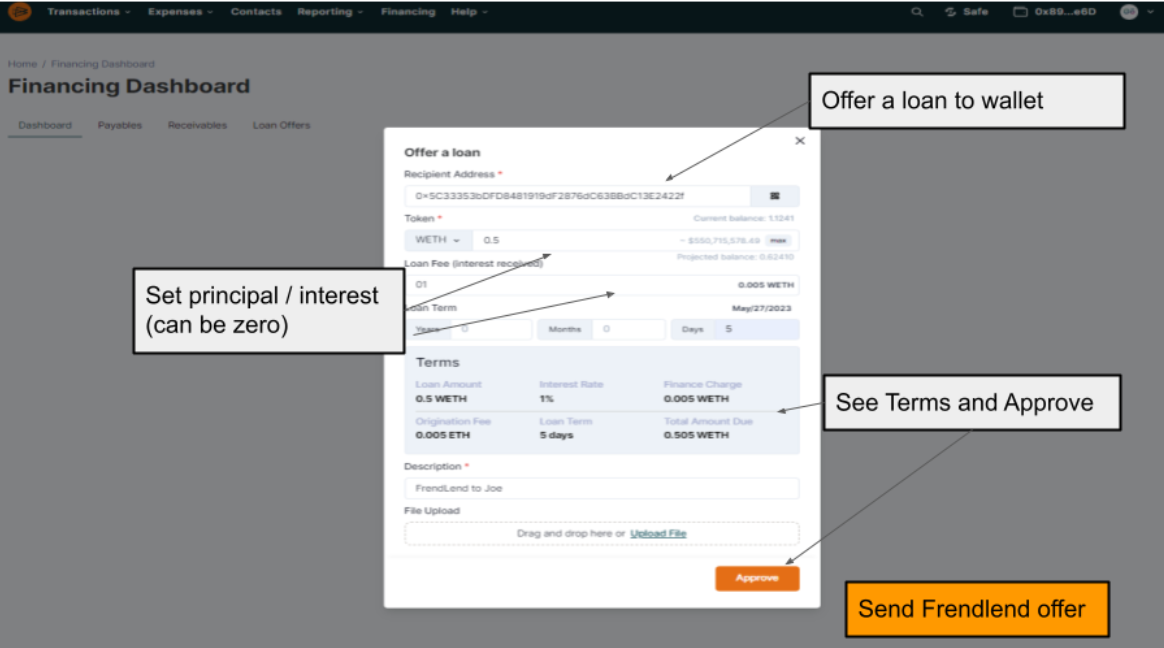

If you want to offer a loan on Bulla, you can access Bulla’s financing feature from your Bulla dashboard. The app allows you to mint an NFT loan offer agreement, like the one pictured below. On it, you enter the wallet address of the borrower, set the principal and interest terms and then send the NFT agreement to the borrower.

At the moment, the loan is a ‘fee for the principal’ agreement. This means it can be paid back at any time, but the fee never adjusts for early repayment. It is meant to be a very simple short term loan. In the future, Bulla will offer more flexible loans with features like early pay, compound interest and valid time period for an offer.

The recipient accepts the offer, the NFT loan offer status goes from ‘offered’ to ‘paying’ and Bulla sends crypto from the lender to borrower wallets (no escrow). The lender has approved the transfer of stable tokens at time of issue, however if the loan is accepted but the lender has in the meantime no balance, the process will fail. At the end of a successful process, the borrower will see a loan payable and the lender a loan receivable.

Bulla can facilitate these P2P loans across all 14 chains that Bulla supports, including Mainnet, Polygon and Avalanche and using any ERC-20 token.

The completed NFT offer and redemption will flow through to the ‘payments made or received’ panels on the user’s respective Bulla dashboards. Any pending loans can be viewed in the Bulla finance dashboard.