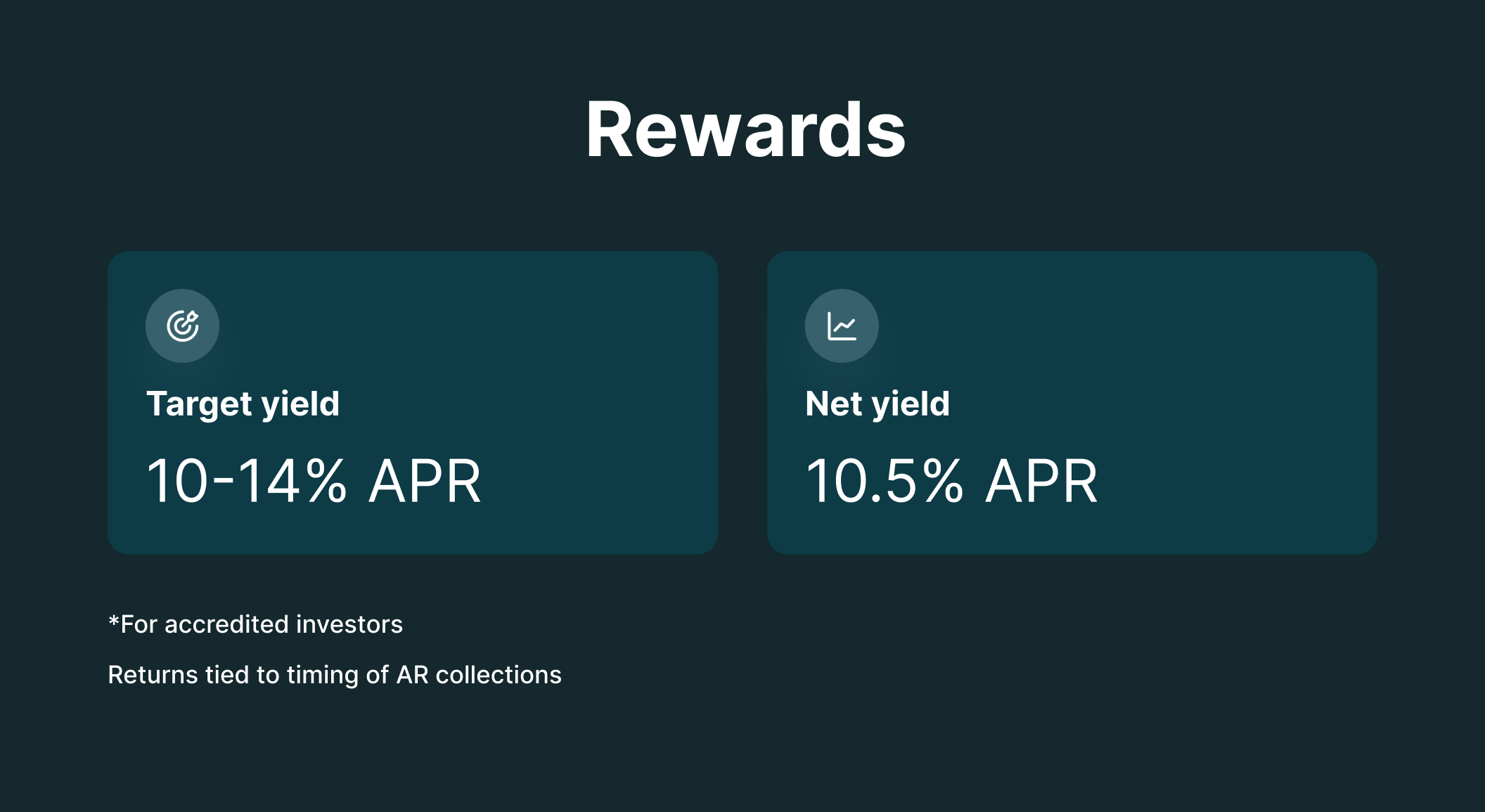

Exclusive Offering for Accredited Investors

- Earns higher yield than traditional fixed income

- Low credit risk with AA/AAA issuers

- Exposure to Net 30 – Net 60 day invoices

- Bulla process enhances speed & transparency, lowers costs

Risks

- Payment delays or impairments

- Average 30-day redemption period, maximum 40-days

Added value

- All activity is visible 24/7 on Bulla website

- White glove onboarding process

- Trade Finance On-Chain

Bulla x TCS Blockchain

While small transportation companies haul 75% of America's freight, they are routinely forced to sell freight invoices to factoring companies to avoid 30-180-day pay terms – often surrendering 30% or more of net revenue just to get paid in 10 days. Bulla and TCS, a trade finance provider, enable on-chain settlement for carriers, providing liquidity in 1-2 business days, up to 90% cheaper than factoring.

Bulla settles freight invoices on-chain, minting and financing 30-60 day AA/AAA commercial paper credits. Bulla enables on-chain invoice financing, AR settlement, and working capital.

How it works

- Bulla deposits (USDC**) into pool →

- Pool finances AR for TCS truckers →

- Truck delivery debtors pay pool →

- Bulla digital receipt (Bulla Finance Token BFT) gains/decreases in value

- Investors may redeem funds at any time, subject to liquidity

*Past performance is no guarantee of future performance.

**USDC is a digital dollar, also known as a stablecoin.

From the blog

Learn more about Bulla's finance mission

Stay up to date on the latest in Bulla's platform and technology.

Stablecoins

1 min read

Investment opportunities are accelerating use of stablecoins

The rise in stablecoin use is due in part to the growing use and diversity of DeFi investment opportunities.

Jennifer Lisle

January 31, 2025

web3 finance

2 min read

Why Tokenizing Real World Assets Matters: The Freight Finance Revolution

Why Tokenizing Real World Assets Matters: The Freight Finance Revolution

Mike Revy

June 12, 2025